SERVICES

Raytelligence stands out by partnering closely with businesses to provide hands-on, long-term support. We offer tailored resources and expertise to ensure successful public listings, spinoffs, and strategic roll-ups, all while maintaining the unique values of each company. Our focus is on creating sustainable shareholder value through targeted, high-growth opportunities.

OUR APPROACH

Raytelligence is different from conventional firms offering IPOs. Our group have deep operating backgrounds. We look to become value added partners with every business we work with and take a long-term view ensuring that the unique culture and values of the organisations we devote our time to are respected and maintained.

Raytelligence works closely with each company to ensure we provide the right set of resources. Our team won’t hesitate to ‘”roll up our sleeves” and are not looking to be passive partners. We bring significant capability, expertise and capital to provide business going public an attractive option compared to traditional methods.

- Raytelligence forms public subsidiaries with 4,500 shareholders for ready for RTOs with companies fitting our criteria to go public in Stockholm.

- We are compensated for its advisory services in cash and equity.

- Our team provide restructuring, merger and acquisition, tax advice and public market consulting.

- We introduce you to our funding partners, banks, and institutions needed for the RTO process.

- Offerings to retail investors

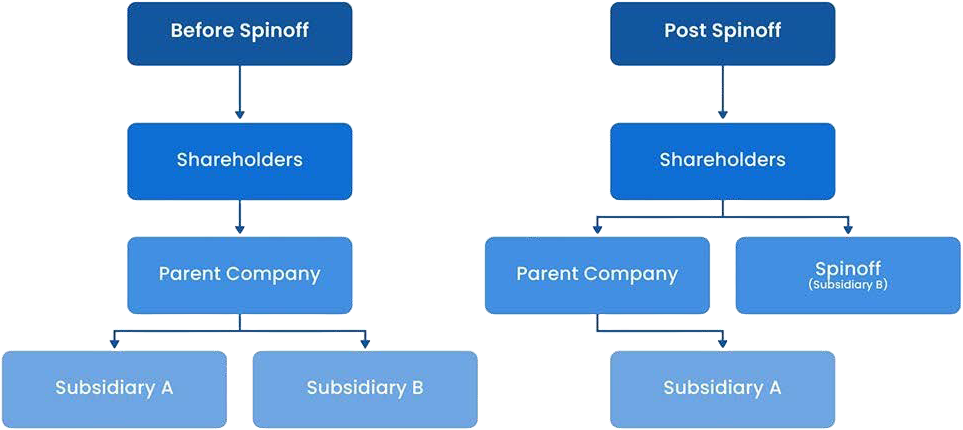

SPINOFFS ANOTHER GO PUBLIC FORM

Raytelligence creates separate independent companies and issues shares in the new blank check companies to its existing shareholders. The shares are issued on a pro-rate basis. The objective is to generate attractive and sustainable longterm returns for shareholders.

In contrast to IPOs, one advantage of a spinoff transaction is Raytelligence does not need to time “market windows” due to the fact that a spin-off is a distribution of shares. As a result, Raytelligence could be able to dictate timing and have greater certainty of execution.

TARGET OPPORTUNITY CHARACTERISTICS

High-Value, Niche and Differentiated Target Sector Focus

Raytelligence’s vision is to identify the next disruptive business that can create a substantial shareholders value. The Company has not selected any business combination target and have not, nor has anyone on the Company’s behalf, initiated any substantive discussions, directly or indirectly, with any business combination target. Raytelligence intend to focus the search on busines targets in technology segments such as consumer internet, enterprise software, fintech, digital health, proptech, gaming, agtech, as well as storage and transmission services, data bases and payment processing services. in Europe. However, Raytelligence subsidiaries may pursue an initial business combinations in any business, industry or geographical location, the management intend to focus our search on target businesses with enterprise values of approximately EUR 150 million to EUR 1 billion.

Key target criteria: Strong financial profile, public market ready, proven management, and attractive returns.

- Company Size: minimum €10M

- Headquarters: Europe, Americas, India, Singapore and Australia

- Equity Investment: €10-50M

- Type: RTO & IPO

- Company Characteristics: Recurring revenue, Strong, quantifiable value proposition, Consistent history of growth

- Business Services

• Software

• IT Services

• Healthcare

• Telecommunications

• Natural resources

BUY-SIDE ADVISORY

Advises on domestic and cross-border acquisitions and expansion opportunities.

- Evaluation of strategic expansion opportunities

- Target identification, evaluation, and contact

- Negotiation, structuring, and closing of transactions

- Cross-border public company mergers

ROLL-UPS, COMBINATIONS AND MULTI- TARGET DEALS

- Identification of potential targets

- Structuring of the roll-up or combination strategy

- Pre-packaging of the roll-up, negotiations and business planning

- Investors roadshows

- Structuring and Closing